Survey: Markets and policy top farmers’ concerns for 2021

© AdobeStock/mreco

© AdobeStock/mreco Few in the farming industry, and in society at large, will forget 2020. As our Review of the Year in the previous issue of Farmers Weekly portrayed, it was both a year to remember and a year to forget – and that is very much the conclusion of our latest Sentiment Survey, conducted in November to assess farmers’ experiences of 2020, and their hopes for 2021.

In total, almost 700 farmers took part, providing a comprehensive overview of the mood in the sector, across all enterprises and all parts of the country. Overall, the results show that, while one-quarter said their businesses had enjoyed a “good” or “great” year, a larger proportion – about one-third – described 2020 as either “bad” or “terrible”.

Perhaps surprisingly, this was not so much to do with the coronavirus pandemic – more than half of those farmers responding said their businesses had not been affected by Covid-19. Indeed, some even suggested they had benefited from the crisis.

About the survey

- Almost 700 farmers took part

- 72% were owner-occupiers, 15% were tenants, 6% were farm managers

- 62% had cereals, 49% had beef, 42% had sheep, 15% had dairy and 11% had pigs

- Whole country covered, but strongest response from South West, Midlands and East Anglia

- Average farm size was 390ha, though 41% had less than 100ha

- Average age was 56, with just 8% under the age of 35

See also: Survey reveals how young farmers view their future

Demand for food stayed strong throughout the year and, while there were clear market disruptions, with negative implications for some – for example, dairy farmers whose buyers supplied the food service sector and sheep producers who saw wool values hit the floor – others enjoyed a welcome firming of prices.

Indeed, a look at the Farmers Weekly Markets at a Glance shows most commodity prices sitting well above year-ago levels, with many farmers enjoying an income boost.

But one-third of respondents still described the coronavirus pandemic as “negative” for their businesses. Geographically, it was notable that farmers in the north of the country were the most likely to have seen it as negative – possibly because the second wave of coronavirus infections and the tougher government lockdowns this autumn seemed to focus on the North.

Farmers with diversifications into agri-tourism and leisure activities were also badly affected by the first lockdown, although the trend towards “staycations” in the summer offset some of the damage.

Extreme weather

But, putting coronavirus to one side, there were many other factors that challenged farmers in 2020 – none more so than the extreme weather, with a warm, wet winter, a hot, dry spring and then, for many, a wet and windy summer.

It was notable from the survey that larger-scale farmers – and typically those in the Midlands and east of the country – were most affected by the weather, with 69% citing it as the greatest challenge, compared with 55% for the whole survey. And this same group of farmers, those with more than 500ha, were twice as likely to have described the year as “bad/terrible” for their businesses.

The likely explanation is that more of these farms would include arable enterprises, which were so adversely affected by poor crop establishment in the autumn, restricted crop development in the spring and a difficult harvest. Yields for all crops were badly affected in 2020, to such an extent that the national wheat yield only just scraped above 7t/ha – 20% down on 2019 – while OSR was 16% lower at 2.8t/ha.

Fresh challenges

Looking ahead, it is not surprising to find a different set of challenges occupying farmers’ minds. Yes, the weather is still a prime concern for 18% of respondents – surely it can’t be as bad a last year, can it? But the real concerns looking ahead are market conditions and government policy.

The two are, to some extent, inter-related, but separating them out for now, the fears about what might happen to commodity markets in 2021 are considerable.

According to our survey, it is smaller family farmers and those in the South West, North and Scotland who are most worried, and with very good reason. For typically it is these farmers who are more likely to be livestock keepers, and so exposed to the full effects of a no-deal Brexit outcome.

At the time of the survey, in November, this was very much on people’s minds, with the prospect of hefty tariffs on exports to the European Union – which account for about one-third of all UK sheep production currently – likely to have a devastating effect on returns.

The Country Land and Business Association recently had calculated that, under a no-deal scenario with tariffs on UK exports, some three million lamb carcasses could have to come back to the UK market.

“The impact of this will be to depress prices, and nearly two million carcasses might not be sold,” it speculated. “Many farmers are under the most enormous pressure. They fed the nation through lockdown and are on the cusp of readjusting their business for a new life outside the CAP. Now many face the complete collapse of their market.”

As Farmers Weekly went to press before Christmas, there was still no clarity on a trade deal, though the closure of ports due to coronavirus fears gave a flavour of the disruption that might ensue.

Malting barley and beef also stand to lose key markets. And it’s not just about tariffs. The economic implications of the pandemic is still to be felt, with rising unemployment inevitable, affecting consumer spending – even on food – while higher taxes will be needed to start paying off the unprecedented government debt. Doubts also remain about the future of agricultural tax concessions, whose days many fear are numbered.

Government policy

The split between large and small farms, those in the North and those in the South, and younger farmers and older ones in our survey is far more uniform when it comes to government policy – it seems everyone is equally concerned.

Again, the timing of the survey in November may have muted the overall perception of this challenge, for it was only at the very end of the month that Defra minister George Eustice spelled out further details of what the new post-Brexit agricultural policy might look like for English farmers.

The cuts planned for the Basic Payment Scheme (BPS) took many by surprise, with the 5% reductions in 2021 for those receiving less than £30,000 rising to 50% by 2024. Larger holdings will face deeper cuts still, so that a 1,000ha estate will be losing 65% of its BPS in four short years.

Yet details of how this will be recouped through the planned Environmental Land Management scheme remain scant.

Some grants for equipment and technology may be available as soon as next year under the Agricultural Transition Fund, but this is likely to be only a small slice of the budget.

A better-funded Sustainable Farming Incentive will kick in the year after – though what hoops farmers will have to jump through and how much they will receive in return is unclear.

The working assumption, however, is that farmers will not be able to recoup all the money lost from the BPS, despite government claims it will be ring-fenced.

“I am unable to see how Environmental Land Management is going to provide sufficient income to come anywhere near the BPS,” said one South East farm owner, responding to the survey.

There will also be an inevitable redistribution, as some farmers and rural businesses do better than others at developing and accessing public goods schemes.

And after 2024 there will almost certainly be budget cuts, once the current government is relieved of its manifesto commitment to keep spending on agriculture the same as it is now.

It is noticeable from the survey, however, that tenant farmers are a lot more concerned than owner-occupiers when it comes to government policy, with 46% citing it as their number one concern for the future, compared with 28% of owner-occupiers.

There are particular fears that some tenants may struggle to get into some of the new agri-environment schemes without their landlord’s consent, and that land may be lost from the tenanted sector if landowners want to go into landscape recovery projects.

There are also some regional differences emerging. Scottish farmers are less concerned about government policy than their English counterparts.

Farm support is a devolved matter in Scotland and Scottish rural affairs secretary Fergus Ewing has already spoken warmly of retaining direct payments and production-linked supports to 2024 – and possibly beyond.

Of course, it’s not all about money and politics, and a number of participants cited different challenges for the year ahead that are weighing heavily on their minds, including rural crime and mental health. “Hare coursing seems to be continuing and soon there will be no hares left. Then the miscreants will revert to thieving,” said one South East respondent.

Optimism and commitment

Despite all the challenges, there is still a degree of positivity shining through, with 42% of respondents either “optimistic” or “very optimistic” about prospects for their farming businesses over the next two years, compared with 32% who were “pessimistic” or “very pessimistic”.

It was apparent that younger farmers are more optimistic than older farmers, with 62% of the under-34s having a positive view, compared with just 37% of the over-55s.

It is notable from the survey, however, that there is less overall optimism about the short-term outlook, which is probably down to the expected effect of Brexit in the first six months of the year, with the attendant market disruption and readjustment outlined above.

But the survey also illustrates a commitment to farming. One question asked was “What would you do with £1m?” and the majority answer (37%) was “invest in the farm”.

Within this group, it is perhaps not surprising to find that it is the younger and smaller-scale farmers who are most inclined to seek to invest, with 42% of those with less than 100ha and 53% of the under-34s giving this answer.

The next most popular answer (18%) was to “invest in something else”, suggesting that diversification remains a real interest for many, while 15% said they would “settle their debts”. Larger-scale farmers were the most inclined to cite these two options.

While it was encouraging to see the bulk of respondents committed to farming, not surprisingly there are a number of “other” ideas of what to do with £1m.

Suggestions include “buy a better piano”, “set up an animal sanctuary” and “buy a new car”. One farmer from the North West said he would “buy another farm where it doesn’t rain all the time”, while a Scottish farmer charitably said he would “help a young person get started in farming”. Meanwhile a Welsh farmer, understandably, said he would “badger-proof the entire farm”.

How do you expect prices to change over the next 12 months?

Contrary to the apparent optimism shown by farmers, there also appears to be a degree of realism, with more respondents (81%) anticipating that input prices will rise over the next 12 months, while the majority view is that output prices will fall.

Looking back over past surveys, the fear of rising input prices is fairly consistent – with about 80% of farmers predicting a “slight” or “significant” increase over each of the past four years. Surprisingly, however, there appears to be a little bit more optimism around output prices, with fewer anticipating a decrease in the next 12 months than in previous years’ surveys.

How do you perceive the impact of Brexit on your business?

As with previous sentiment surveys, there is a good deal of pessimism around the effects of Brexit, with twice as many respondents thinking it will be negative rather than positive.

This is not surprising as the country moved towards the end of the transition period. For when the survey was conducted in November, a no-deal outcome was looking likely and market disruption inevitable. As Farmers Weekly went to press before Christmas, there was still no decision.

There is also the prospect of greater competition from overseas suppliers further down the line, especially if the government embarks on a cheap food policy to satisfy consumers.

It is perhaps not surprising to see that smaller-scale farmers in the survey are the most negative, while older farmers are the most positive. Regionally, the South West is the most positive, perhaps reflecting the stronger pro-Brexit vote in that area, while East Anglia and the North are the most negative.

Past research by Farmers Weekly has found that farmers were marginally in favour of Brexit at the time of the EU referendum in 2016, with an estimated 54% voting “leave” and 46% voting “remain”. We also found that, even among those who voted leave, there was still an anticipation of some economic pain – but this would not have changed the way they voted.

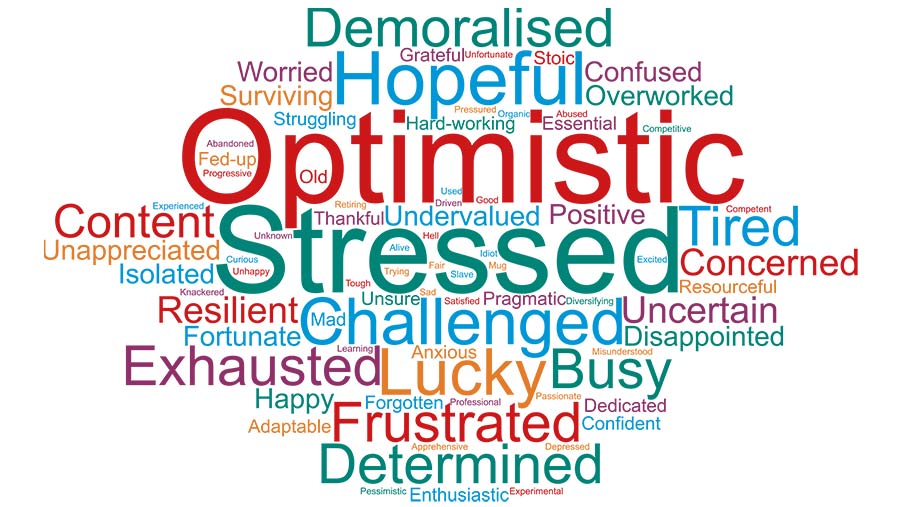

What word would you use to describe yourself as a farmer?

This question is always a bit of a free-for-all, with a strong mix of both positive and negative associations as shown by the resulting word cloud. “Stressed” and “Optimistic” seem to be the overriding emotions – indicative of the widely varying attitudes and experiences of those working in the industry.

We also asked a separate question about how people feel about working in the farming sector, in which the options given were demoralised, busy, rewarded, uncertain, hopeful, stressed, happy and appreciated. The most popular answer is “busy” – with the under-34s in the survey the busiest of the lot.

But the least popular answer is “appreciated”, suggesting farmers feel they are undervalued. This is perhaps unjustified, as NFU-commissioned research during the course of the year showed that farmers have never been more valued in the eyes of the public, thanks in part to their efforts to keep the supermarket shelves stocked during the coronavirus pandemic. Three-quarters of the public expressed a positive view of farming in 2020.

How would you vote if there was an election tomorrow?

Farmers are generally a fairly conservative lot – with both a small “c” and a big “C”. And so it proved to be with our survey question on voting intentions, with a massive 72% saying they would vote for the Tories.

There are, of course, regional differences, with the South East the most Conservative (82%) and Scotland the least Conservative. There appears to be 27% support for the Scottish National Party among farmers north of the border.

Given this penchant for the Conservatives, it is perhaps little surprise to find that, among the 462 farmers who answered the question, Boris Johnson is deemed the most impressive politician of the past 12 months (with 22% naming him), followed closely by his chancellor, Rishi Sunak (15%).

But, as if to prove what a “Marmite” figure the prime minister is, when we asked “who is the most annoying politician of the past year?”, Boris Johnson topped the rankings again at 23%, with Jeremy Corbyn snapping closely at his heels on 20%. Both were deemed more annoying than Donald Trump and George Eustice.

What is the biggest change you plan to make in the next three years?

This question prompted a huge range of answers. Here is a selection:

- “Trying to sell direct to the public.” 100-200ha farmer, South West

- “Digitise my farm recording.” 100-200ha farmer, East Anglia

- “Hand more control to younger generation.” 500ha+ farmer, Yorkshire and Humberside

- “Take advantage of environment subsidies, reduce machinery overheads.” 200-500ha farmer, South East

- “Maybe invest in a robot dairy unit, depends on the outcome of Brexit on 1 January.” 200-500ha farmer, Northern Ireland

- “Invest in new grain dryer and storage, to save tractor movement and carbon emission on the farm.” 500ha+ farmer, South East

- “Simplify the workload and improve conditions for family and staff. Stop being a busy fool.” 200-500ha farmer, Scotland

- “Try to reduce debt.” 200-500ha farmer, Wales

- “Become more liquid. Currently running pedigree cattle, but going to keep more commercials.” 200-500ha farmer, Midlands

- “Sell up while there are still idiots to buy it!” 100-200ha farmer, East Anglia.

In partnership with

Agricultural businesses face complex challenges, particularly as we head towards Brexit. We’re here to help lighten the load.

Agricultural businesses face complex challenges, particularly as we head towards Brexit. We’re here to help lighten the load.

In addition to core accounting, we offer specialist advice in obtaining or restructuring finance, inheritance tax planning, diversification, succession planning, agricultural property relief, maximising tax reliefs and reviewing business structures, with a client-led service offering bespoke solutions to local rural businesses.

For more information, pay a visit to azets.co.uk.