Organic sector must change to stem falling sales

There’s no denying it has been another tough year for the organic sector. Sales fell by 3.7% to £1.67bn last year, as cash-strapped shoppers reigned in their spending and major retailers erred away from premium products in favour of price promotions and value packs.

The amount of land farmed organically also fell for the second year in a row, down 2.8% last year to just over 718,000ha and almost 300 producers and processors quit the sector.

Down but not out

The retail sector led the downturn, with overall supermarket organic sales down 5% on the year as many products were de-listed, less shelf space was devoted to organics, and investment in own-label ranges was cut.

Waitrose was the only retailer to invest seriously in promoting its organic ranges last year and consequently saw the smallest drop in sales (2.2%). In contrast, Asda, Morrisons and the Co-op all recorded falls of around 22%, while market leaders Tesco and Sainsbury’s saw sales fall by 5-6%.

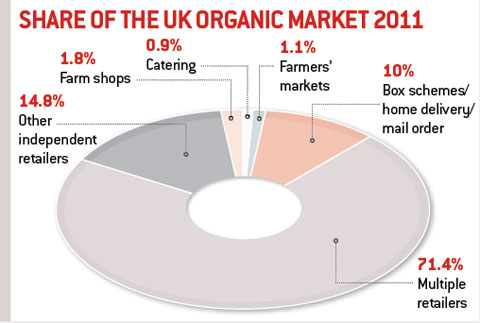

Given that multiple retailers accounted for almost three-quarters of total organic sales (see chart), that 5% fall more than wiped out gains in sales through other routes, the Soil Association’s Finn Cottle said.

The independent retail sector fared best, with box schemes, home delivery and mail order sales up 7% in 2011 to £167m and there was a small increase in catering sales too. Farm shop sales were down 3.5%, while there was a 1% fall in organic sales through farmers markets.

“Organic has always been seen as a premium food positioned at the top of the market, so given the tough trading conditions, I think a 3.7% fall overall is a reasonable performance.

“Organic is down, but it’s not dead. There is still demand out there, and it will only be dead if that’s what retail buyers think, so we’ve got some convincing to do.”

Dairy and veg on top

Dairy products and fresh produce (fruit, vegetables and salad) continued to be the most popular items in the organic shopping basket, together accounting for 52p in every pound spent on organic products (see table).

These both suffered falling sales last year, but the hardest hit were the fresh fish, bread, and drinks categories. In contrast, sales of fresh poultry and baby food both grew and organic lamb (+16%) and butter (+9%) also bucked the declining trend.

“Organic own-label butter looked very affordable so had a good year, while farmgate red meat prices have been closer to non-organic, so there has been more investment by retailers in promoting sales. The volume sold probably hasn’t changed that much while prices have risen.”

Global organic growth

While UK organic sales had struggled, the sector was faring much better elsewhere with promising growth prospects, Ms Cottle said. All the other main European markets were expected to show “double digit growth” in 2012, partly on the back of a more favourable government attitude towards organics in those countries.

Denmark expected growth of 12-18% this year and next, while The Netherlands and Sweden were both up 13%, Belgium and Italy up 10% and France up 12%. The largest organic market, the US, grew by 7.7% despite the same economic pressures and strong growth had also been seen in the Chinese organic market, which had quadrupled in the past five years, she said. Organics Brasil reported annual growth of 40% and organic sales in Asia were predicted to grow by 20% a year over the next three years.

Ms Cottle outlined three key things that needed to change to turn around the UK organic sector:

- Innovation – new brands, farming techniques, animal welfare, make organics accessible and attractive to a wider range of people

- Government support – not necessarily financial support, but a clear policy for organics is needed for all to work towards

- Better communication – led by retailers, supported by brands and amplified by the Soil Association

New image needed

But one of the major challenges for the organic sector will be to get away from its premium, elitist image and appeal to a wider range of consumers.

Some 7% of shoppers accounted for just over half of the total organic spend in 2011, so many still just “dabbled” in organics, Ms Cottle said. There was also a strong bias towards younger, more affluent social groups in London and southern England, something that had being heightened by the economic pressures.

Some progress had been made in appealing to a wider audience, with leading discount retailers Lidl and Aldi stocking an increasing amount of organic food; shoppers spent nearly £3 on organic food in the two leading discounters last year, for every £4 spent in M&S.

“Let’s not lose sight of the difficulties real people are having economically,” Asda’s Julian Walker-Palin said. A survey of 5,300 customers showed around half expected organic food to be the same price as conventional, although many still valued green credentials, he said. “The outward message at the moment is about price, but that doesn’t mean we’re not working on the issues of sustainability.”

The Soil Association’s Rob Sexton said the sector needed to “re-enthuse” retailers to organic and prove that it could be exciting and innovative. “We can’t pretend that we’ll transform the way retailers operate, but we can show how organic can fit in with their strategy as a retailer. We need to communicate the benefits of organic without knocking conventional and stop apologising about price. We should be communicating how it is different and why it is more expensive.”

Get the “phwoar” factor

Nina Thomson from marketing agency The Space Creative said the organic sector should move out of its comfort zone and that there was “huge scope to improve the look and feel of the Soil Association”.

She urged anyone selling an organic product to follow some basic steps to build a successful brand:

- Solid foundations: clearly show what the product will give to consumers (eg health/ environmental benefits) and why they should believe these claims (accreditation); maximum of two or three claims

- Brand sole: make the customer “fancy” the product – use emotional terms to attract them to it and sell the story

- Phwoar factor: decide where your product sits between homely “comfort” brands and more flamboyant “intrigue” brands. Many organic products are in the comfort category, so consider targeting other areas to stand out more

- Engage consumers: shoppers are often reactive and buy a brand/ products in short, sharp bursts. Engage with consumers and build shopper commitment; try to leave a positive lasting impression and make them come back for more

Organic outlook

Threats:

- Prospects remain fragile and linked to high street trends – little sign of quick economic recovery

- Supermarkets not willing to invest in promoting organics – creates self-fulfilling prophecy

- Assurance and accreditation schemes for conventional farming confusing organic’s message for consumers

- Seen as elitist

Opportunities:

- Growth in some parts of organic market, especially independent outlets

- Strong organic sales growth worldwide

- Increasing organic sales among discounters

- Future growth of UK market requires change in attitude among supermarkets and government

- New image could revitalise organics

The Soil Association Organic Market report can be downloaded at www.soilassociation.org

| Reasons for/against buying organic | |

|---|---|

| For | Against |

| Fewer chemicals (62%) | Too expensive (91%) |

| Natural and unprocessed (57%) | No healthier (21%) |

| Healthier image (52%) | Limited range of products (21%) |

| Better for nature/environment (47%) | Don’t know enough about it (15%) |

| Tastes better (44%) | Can’t tell it’s organic (13%) |

| Safer to eat (41%) | No nutritional benefit (13%) |

| Higher animal welfare (34%) | Not the sort to buy organic (13%) |

| Source: Soil Association market report | |

| Product share of UK organic market | ||||

| Product | Share % | Value (£m) | 2010-11 change % | |

| Dairy | 29.2 | 528 | -8.9 | |

| Fruit & Veg | 22.9 | 272 | -5.1 | |

| Baby food | 13.3 | 158 | +6.6 | |

| Beverages | 6.4 | 71 | -13.6 | |

| Fresh meat | 4.8 | 57 | -5.7 | |

| Fresh poultry | 2.2 | 26 | +5.8 | |

| Bread | 1.1 | 13 | -13.6 | |

| Fresh fish | 0.5 | 6 | -24.6 | |