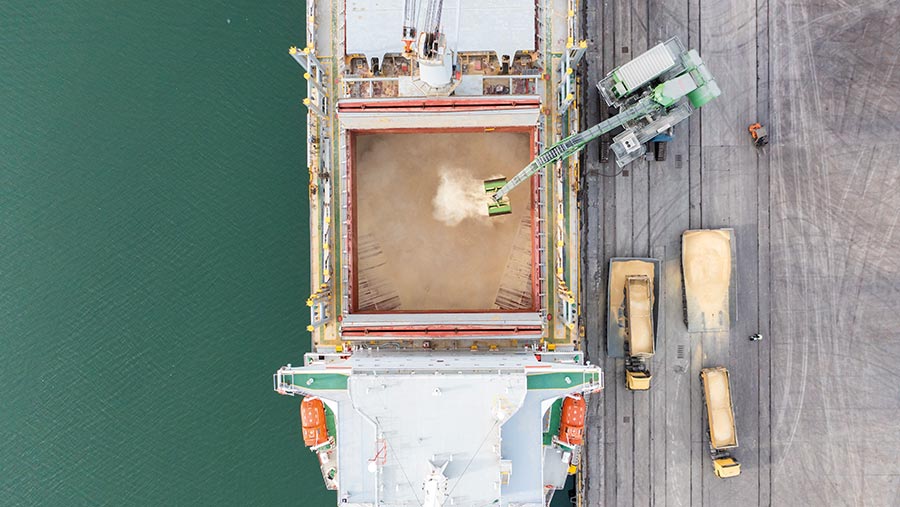

Black Sea grain deal creates turmoil for wheat markets

© bfk92/iStockphoto.com

© bfk92/iStockphoto.com Uncertainty surrounding the future of grain exports from Ukraine is affecting global markets, helping to underpin prices in the short term.

Market sentiment for wheat markets has been fairly low internationally in recent weeks, according to traders, with UK exports struggling to compete.

However, if the Black Sea grain export deal is not renewed, both domestic and global prices are likely to rally.

See also: Large volumes of cereals still on farm from last year’s harvest

Negotiators from the United Nations (UN), Ukraine, and Russia were still to reach an agreement to extend the deal, which allows ships with grain on board to leave Ukrainian ports, beyond 18 May, as Farmers Weekly went to press midweek.

The UN reported that intense discussions were ongoing to try to secure an extension.

However, Russia remains unsatisfied with how its own agricultural exports are being treated as part of the deal, according to grain trader ADM.

DSM Capella was the last vessel to leave Ukraine via the corridor on 17 May, ahead of the deadline, carrying 30,000t of maize to Turkey.

Figures from the UN’s Joint Coordination Centre show more than 950 loads have been shipped using the corridor since it was created in July 2022.

Martin Griffiths, UN under-secretary-general for humanitarian affairs, said 30m tonnes of cargo have been safely exported from Ukrainian ports under the initiative to date, with 55% of this going to developing countries.

Global markets remain volatile, and both Chicago and Paris wheat futures have received mixed support in the past week.

UK wheat futures have followed the wider global trends and opened at £196.80/t on 17 May for the November contract.

Spot prices collected by Farmers Weekly on 17 May for feed wheat stood at £180.38/t, up just £0.67/t on week-earlier levels.

Global supply situation

A tighter supply of wheat is forecast in the US, according to the US Department of Agriculture’s latest World Agriculture Supply and Demand Estimates (Wasde) report, which could add some support to prices in the short term.

Andrey Sizov, head of market analysis firm SovEcon, said Ukraine has about 5m-6m tonnes of wheat and maize left to export from the current season.

Russian wheat stocks are at record highs following a large harvest last year, according to Mr Sizov.

There is also a degree of speculation among traders and the industry that a small percentage of this increase is a result of Russian looting of grain from regions in Ukraine.

Longer term, global wheat markets are expected to remain bearish during the summer months and into the new crop year, with large global supplies of wheat putting pressure on prices.

The latest Wasde report on 12 May suggests that global production in 2023-24 is projected at a record 789.8m tonnes, with lower production in Australia, Russia and Ukraine being offset by larger crops in Argentina, Canada, China, the EU and India.

Global trade and consumption are both expected to be lower for the 2023-24 crop year.