Advertiser content

Defra’s Nature Markets Framework: What you need to know

Megan Hesketh

Senior Analyst – Arable

Recently, Defra released updates on how they plan to support farmers and land managers in confidently accessing private sector payments alongside public payments (e.g., the Environmental Land Management scheme), for providing environmental benefits in England.

There are increasing opportunities for accessing funding through private nature markets, receiving payments for carbon sequestration, improving water quality, and enhancing biodiversity. You can find the latest analysis on carbon markets on the AHDB website.

© AHDB

Defra set out a target for private investment into nature recovery to meet at least £500 million per year by 2027, to then reach over £1 billion per year by 2030 in England.

For the devolved nations, Defra have committed to work closely with devolved administrations to align policies where appropriate and build on successful joint initiatives.

At the end of March, Defra released information both on the Green Finance Strategy to attract investment, and Nature Markets Framework. Developing high-integrity nature markets is reportedly key to Defra’s strategy, to mobilise investment in the environment.

Today, I look at the Nature Markets Framework. I pick out some key takeaways and unpick what this might mean for you.

Understanding the Nature Markets Framework

Nature markets enable private investment in nature, through creating units or credits that can be bought or sold.

Though investment could also be in other non-credit ways, for example repayable finance for projects. Markets can either be voluntary or regulatory.

These markets allow businesses to invest with farmers, and other land/coastal managers to enhance the ability of natural and farmed land, freshwater and marine habitats to provide nature recovery, carbon, clean water, and other benefits.

Some elements of nature markets are already well established, for example UK Woodland Carbon Code and UK Peatland Code.

Whereas other areas are new and emerging, for example voluntary carbon markets. Coming down the line, the Forestry Commission are exploring development of a Woodland Water Code by March 2025.

This Nature Markets Framework is to scale up existing markets, though this may take a few years.

Defra are working with the British Standards Institution (BSI) to develop a range of nature investment standards which provide clear rules for how farmers can access payments from nature markets.

Knowing what is on offer, and how to access these nature markets, both through government schemes and private markets, is an essential tool for farmers for business resilience.

AHDB continues to support the industry through providing information surrounding developing markets, specifically carbon markets.

Core principles of nature markets

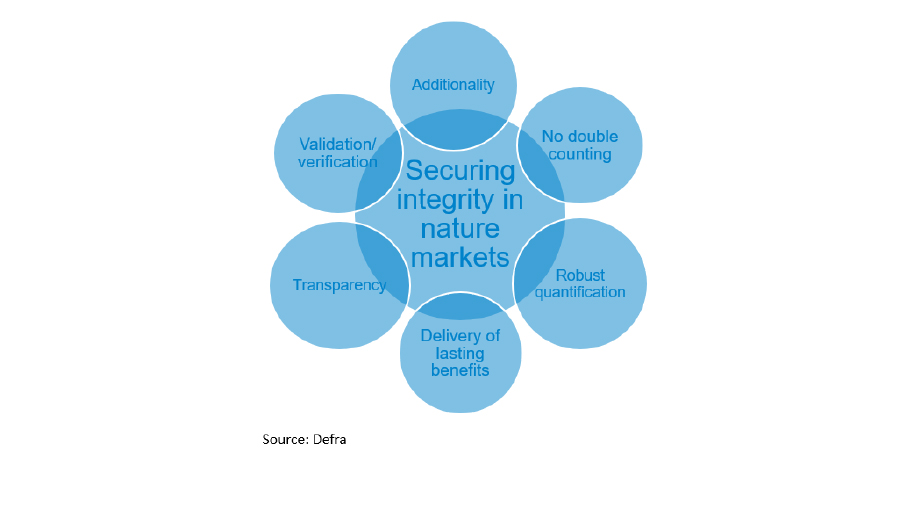

At AHDB, we have talked before about ensuring market value for credits through meeting four requirements: credibility, additionality, permanence and verifiability.

Defra too have laid out the core principles to ensure integrity and value in markets. This means credits are robustly verified and transparently documented, with no double counting or greenwash.

© AHDB

For definitions and more information on these areas, take a look at the report.

All these core principles are vital to secure value in credits. I focus in on two areas, the first no double counting.

This means quantified credits/units of same ecosystem service cannot be sold twice or used as basis for two claims.

Additionality means credits need to be based on new environmental improvements, verified against an appropriate baseline.

Mentioning a baseline, a key action now if you are unsure how to get involved, is understanding what you have on-farm: creating a baseline. This is because you need to show additionality and improvement, for market value.

For example, using a carbon calculator to understand your own farm’s carbon emissions. The bigger the baseline (number of years), the better (more robust). Choose a calculator that works best for you and stick with it.

On the wider picture on measuring, Defra also confirmed that they are developing a consistent approach for measuring emissions from farms. By 2024, Defra will set out how farmers will be supported to understand their emissions through carbon audits.

Market rules

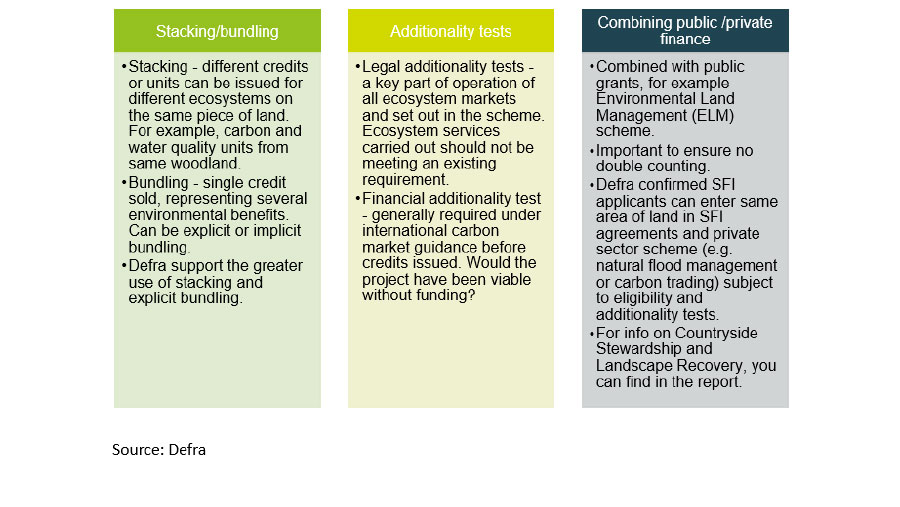

Defra have also explained market rules within their framework. Important considerations when exploring nature markets.

© AHDB

For more information on market access through farming schemes, there is a wealth of information in the report.

Within the report, Defra announced they have commissioned the Green Finance Institute to develop an online toolkit for farmers to identify and navigate opportunities across nature markets, due to be available this summer. Something to look out for.

What does this mean for you?

There is a lot of new information in these releases. A key takeaway is that there is value in providing environmental benefits, not just soil health benefits, but also as value through government schemes and private markets.

A clear goal of Defra’s is to encourage farmers to get involved, and to add credibility to private nature markets to incentivise investment.

Over the next few years, we are expecting the development of nature investment standards with BSI, as well as developing a consistent approach to measuring emissions.

This development of standards brings more oversight into voluntary markets, though builds on the core principles of credits, which inherently links to value too.

Some concerns remain across the industry in securing integrity in nature markets. However, this news brings a step forward in understanding the direction of these markets, though results of these new commitments may be some time down the line.

If you are looking to get involved in a scheme, it is recommended you seek legal advice. It is also worth understanding what supply chain commitments you might already have across environmental objectives. Looking to carbon markets specifically, what we do know is that voluntary market value is likely to increase going forward, as companies look to reduce their environmental impact. Something to consider.

Unsure where to start, building a baseline for environmental outcomes your farm will be key to establishing value. Do you know what carbon emissions and stocks you already have on farm?

How can I access more information?

Do you have a question regarding carbon markets? To get in touch with us, contact our email address: carbon.markets@ahdb.org.uk.

You can also access information on carbon markets on the AHDB website.

Provided by

AHDB is a statutory levy board whose purpose is to inspire our farmers, growers and industry to succeed in a rapidly changing world.