Global players feel the squeeze

The global poultry industry continues to face the challenge of high feed costs, which is putting margins under pressure in many parts of the world, according to Rabobank’s latest quarterly poultry report.

In developed countries in particular, the industry lacks adequate power to pass on feed cost increases to retailers. Key factors causing this are oversupply, fragmented industries, inflexible supply chains and pricing models in the value chain.

The weak global performance is encouraging some processors to rationalise their supply base, and non-strategic assets are being divested, says Rabobank. For example, beleaguered processor Doux in France has recently sold off its compound feed plant, while Dutch company Vion is in the process of divesting its UK meat operations.

“The most challenged poultry industries are currently in the USA, the EU, Thailand and South Africa, though companies in Russia and Brazil are performing relatively well,” said Rabobank analyst Nan-Dirk Mulder.

“The USA has only recently started making supply cuts, and this is also the case for the EU.”

Margin squeeze

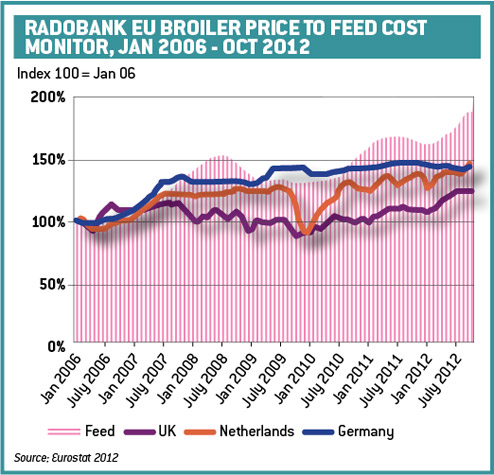

The EU is an example of a region that has seen a structural reduction in margins. Recent levels have fallen from historic averages of 6-7% to 4-5% and even lower during some of the spikes in compound feed prices that have been seen this year.

“The EU poultry industry is being squeezed as broiler prices have increased only 3%, while average compound feed prices went up by 7%,” says the report.

“The supply of chicken has remained high, especially for breast fillets. In the current economic situation, consumers tend to choose cheaper products such as chicken legs.”

In the USA, current margins are slightly better, although well below historic levels. Supply reductions have paid off here, but not yet enough.

Global trade has also reduced in the third quarter of 2012, falling by 4% year-on-year – the first time it has dropped since 2008. Rabobank attributes the decline to falling demand in key importing regions like Japan, Hong Kong and Saudi Arabia, as well as weak economic conditions in Europe and Asia.

Future prospects

Commenting on the outlook for the poultry industry, Mr Mulder said: “The first quarter of 2013 is likely to be challenging as higher feed input costs move through the flocks.”

Profitability is expected to be negative for many processors in many parts of the world.

“Beyond that, returns will depend on industry discipline in keeping production sufficiently moderated to get prices higher and offset increasing costs.”

Developments in the South American maize and soya crops in early 2013 will be crucial in terms of setting the scene for feed costs in the rest of the year.

On the positive side, however, the report suggests that reduced beef production in the USA and pork output in Europe could provide something of a “price umbrella” for global poultry markets. “But the price of poultry primarily depends on its own supply/demand dynamics.”

FACING THE FUTURE

Global demand for poultrymeat is slowing, but will still outstrip beef and pork as the meat of choice over the next decade.

Addressing the European Poultry Club’s “Facing the future” seminar at EuroTier in Hanover, global poultry consultant Paul Aho (pictured above) said there had been a structural slow down in consumption since 2007.

This was partly due to the higher grain price and world recession, though these would normally only have a temporary effect. What had changed permanently was the consumer response in terms of meat eating to changes in per capita income.

“At the point when people were poor and they started to get some income, one of the first things they bought was some meat,” he said. “Then, after they’d gotten some meat and made some more income, they started buying other things – education, some housing, maybe a motorcycle.

“So the growth that we can expect for every percentage increrase in per capita income is now slower than it was before.”

But Mr Aho was confident that poultry would still outperform other meats.

“I think the consumption growth in beef going forward will only be in line with population growth, and the same thing with pork. It’s in poultry and chicken where the feed conversion efficiency will help us to exceed population growth.”

The “engine for growth” would be in the middle income developing world – China, India, the Middle East and Latin America – where poultry was income elastic.

Mr Aho predicted a 42% rise in production in Asia and a 36% rise in Latin America by 2022, with just a 15% increase in the US and the EU.

He also saw a drop in feed costs on the horizon. “I think the highest feed prices are going to be in this crop year. This is as bad as it is going to get. They’re going to fall off, and when we have a good crop in the US, they’re going to fall off dramatically.”