How UK dairy producers can compete globally

© Tim Scrivener

© Tim Scrivener The UK dairy industry is in a strong position to compete on a global scale, but it must be poised to make some fundamental changes, writes Tony Evans, head of business consultancy, the Andersons Centre.

The UK dairy industry can and does compete fiercely with almost all mainland European countries.

See also: What farmers in other countries get paid for milk

Recent European dairy farmer costing comparisons have consistently demonstrated that UK milk production can be, and is, the second lowest cost in Europe, with Ireland being the lowest.

Tony Evans, head of business consultancy, The Andersons Centre

The principal reason is that the UK receives adequate rainfall to grow sufficient grass to produce low-cost milk.

But in order for us to remain competitive dairy businesses must adapt to compete.

If we look at the price increases of major inputs for a dairy farm since 2007 it clearly demonstrates this (see table below).

How input prices have risen since 2007 |

|||

| 2007 | 2016 | % difference | |

| Milk price (p/litre) | 20.7 | 20.5 | Nil |

|

Wheat price (£/t) |

95 | 99 | +4% |

|

Rape (£/t) |

94 |

174 |

+85% |

| Oil (USD/barrel) | 65 | 40 | -38% |

| Tractor diesel (p/litre) | 35 | 35 | Nil |

| Ammon nitrate (£/t) | 160 | 220 | +38% |

| Urea fertiliser (£/t) | 185 | 195 | +5% |

| Electricity (unit cost/p) | 5.2 | 10 | +92% |

| Living wage (£/hr) | 5.3 | 7.2 | +36 |

In order to combat rising input prices, dairy farmers must become more efficient by:

- Using less concentrates

- Challenging the UK ammonium nitrate manufacturers as a result of lower oil prices

- Considering using urea fertiliser

- Using less electricity a litre

- Increasing the milk produced a labour unit.

It is also key to produce the correct milk at the right time of the year. Meanwhile, the milk buyer and processor must invest in efficient, low labour demand plants.

The processor

Three top tips for remaining competitive

- Remember the 10-year milk price average is 25.5p/litre.

- Bank the cash in the high-payment time to assist in the low-payment time

- Build and operate a production system delivers sufficient return at an average milk price of 25.5p/litre

Fundamentally, the pricing mechanisms must change too.

The challenge and confusion within the UK dairy industry is that unlike many other dairy producing countries, we have two similarly sized sectors – liquid and manufacturing are split approximately 50:50.

Each of these sectors have different quality criteria and demand profiles. We must have the correct pricing mechanism to ensure the milk producer invests and operates their business to deliver what is required.

From the top down there needs to be a clear, logical, honest vision and leadership that inspires and informs all in the supply chain to run the correct system of milk production in line with the market place.

See also: How to budget for dairy feed supplements

The confusion in the liquid sector is that several supermarkets are paying the correct price for level supply while others such as Morrisons, Asda, Aldi and Lidl, are paying prices that are unsustainable and driven down by the fact there is surplus milk in the manufacturing sector.

This kind of pricing will drive these milk producers to either cease or change to seasonal production systems in order to generate profits.

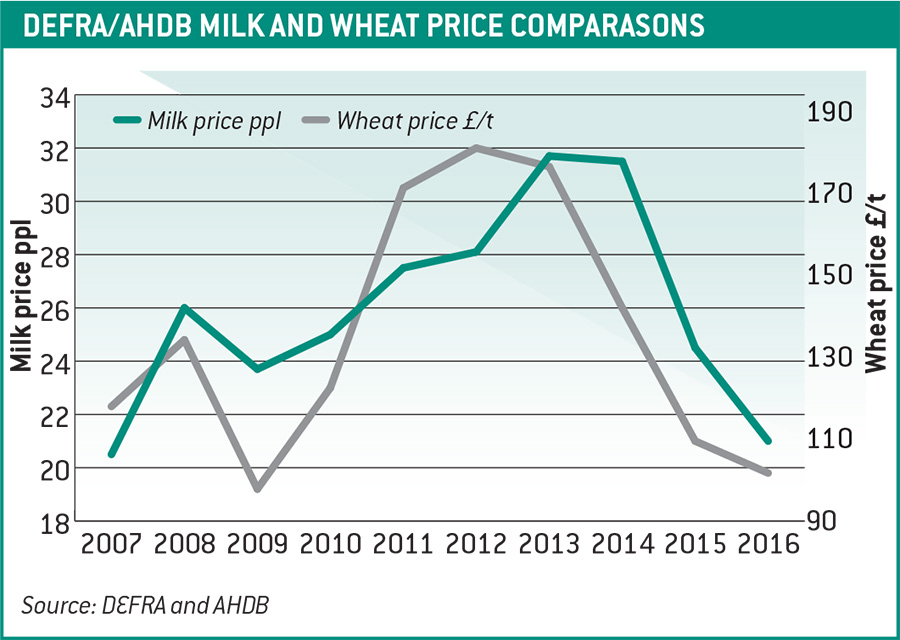

In the manufacturing sector, which is more of a world traded product such as the wheat market (see graph below), all milk producers must adapt to trading in a more volatile environment.

What we need is:

- A joined-up dairy industry that links farm production to the market place

- Joined-up research and knowledge transfer between milk processors and buyers that manage long-term relationships with their suppliers

- Strongly branded products that attract consumers to want to buy British at a reasonable price.

In conclusion, many dairy businesses have the opportunity to change rather than quit – are you up for the challenge?

Many will be better off by changing their milk production system rather than changing their farming enterprise.