Why UK sugar beet has a bright long-term future

© Tim Scrivener

© Tim Scrivener As sugar beet lifting gets under way and this year’s campaign begins, there’s renewed optimism among beet growers and the wider industry amid signs that the crop has a long-term future.

After two years of a shrinking crop area – with a 20% cut imposed by British Sugar to clear the high sugar stocks that arose from the record 2014 crop – there are plans to expand the 2017 crop area and take advantage of more favourable market conditions.

See also: How to minimise sugar losses in beet clamps this harvest

As a result, there’s more choice with contracts, possible bonus payments, additional tonnage on offer and an opportunity for new growers to get on board, as the industry looks to benefit from the new market opportunities envisaged after the end of quotas in 2017.

According to British Sugar’s agriculture director, Colm McKay, there is every reason to be positive about the sugar market and sugar beet production and he predicts that there are some exciting times ahead for growers.

Beet crop offer (existing growers)

- One-year contract – £22/t guaranteed minimum plus market bonus of 10% share of the revenue above €475/t (£419)

- Three-year contract – £22/t guaranteed minimum, plus market bonus of 25% share of the revenue above €475/t for each of the 2017-18, 2018-19 and 2019-20 crops

- Bonus paid up to a limit of €700/t (£618)

World prices

“Currently, world prices are breaking the all-important US$0.20/lb barrier, which is an increase of about 50% since February,” he says.

“We were also expecting the weaker sterling exchange rate to favourably affect sugar beet returns for the 2016 crop, which they have done.

“Growers received letters in early October detailing the 2016 sugar beet contract price increase.”

Both contract tonnage entitlement (CTE) and industrial contract (ICE) prices have risen, meaning all contract beet delivered will receive a fixed price of £21.62/adjusted tonne – up from the previously agreed fixed price of £20.30/t.

This will be paid in full from the start of the campaign, as beet is delivered, and should go some way towards making up for the less-than-ideal early growing season conditions. For most, crops were planted later than usual and there was a cold, wet spring and dull June.

The slightly later start to the campaign means crops may have been able to benefit from the favourable late summer and early autumn conditions, therefore performing better than the initial expectations. However, they are not expected to break any records.

As a result, the surplus price for the 2016-17 season has also been increased above its present levels of £15/adjusted tonne.

“Indications are that the majority of surplus beet delivered this year will be needed to make the national quota,” reports Mr McKay.

© Tim Scrivener

“If this is the case, the price paid for part or potentially all of the surplus beet delivered will be increased to the £21.62/t price. This will be received as a top-up after the end of the campaign and more information will be forthcoming.”

The UK is well placed with its very strong and cost-efficient sugar beet industry, says Mr McKay. “It’s encouraging to see the expansion of crop area and we look forward to working with growers and the new contract choices they have.

“Nobody can predict future agricultural market process with complete accuracy, but we do anticipate improved crop returns in the future,” he says.

2017-18 crop

Looking ahead to the 2017 crop, British Sugar’s new contract incorporates some exciting developments.

Not only is the crop area being increased back to its original size, there are also more choices for existing growers in how they can contract their sugar beet crops.

When the new beet crop offer came out in July, both one-year and three-year contracts were on offer, with a guaranteed minimum price of £22/t, as well as bonuses for sugar market revenue share.

The longer three-year contracts attracted the greatest share of sugar market bonuses, at 25% of the sugar market revenue above €475/t (£419), while the one-year contract had a market-linked bonus of 10%.

The bonus is linked to the average EU market price for white sugar, as published by the EU Commission for each marketing year. It will be paid on the sugar market revenue above €475/t, up to a limit of €700/t (£618).

According to Andrew Fundell of Brown & Co, the new arrangements have given growers the choice they had been asking for. This represents the first time payments will be based on the price of sugar in Europe.

“It’s very evident that we have an industry that is, at last, listening to growers and is pushing forward to be best placed for life without quotas in a more challenging market place.”

A shared “pain and gain” model is a positive move, he believes. “After all, we are selling sugar into the European market, so this type of scheme gives growers the chance to get some of the increased market value back.”

Deciding whether to opt for a longer-term fixed minimum price with a larger share of the uplift or a one-year price with a smaller share is similar to the decisions being made in farming businesses with most other crops, he says.

“It’s about balancing risk and investment.

“Fixing a price now for the next three years does help with investment decisions, and committed beet growers who have already invested heavily in the crop will have been tempted to fix a proportion of their production on the longer-term deal.

“After all, there are plenty of good agronomic reasons to continue growing the crop.”

He warns that the bonus won’t be paid immediately and it will be the end of 2018 before any extra payments are confirmed.

“That’s why the decision for 2017 should be made on the basic minimum price of £22/t. It is up on last year, which shows that things are moving in the right direction.”

‘Sugar beet looks much better than the alternatives at the moment’

NFU Sugar Board member and Cambridgeshire farmer Edd Banks has made the decision to double his sugar beet tonnage in 2017, and will be going from producing 3,200t to more than 6,000t.

His reasons for doing so will be familiar to growers who have spent time analysing their production costs and crop returns.

Edd Banks © Tim Scrivener

“Put very simply, sugar beet is looking much better than some of the alternatives at the moment,” he says.

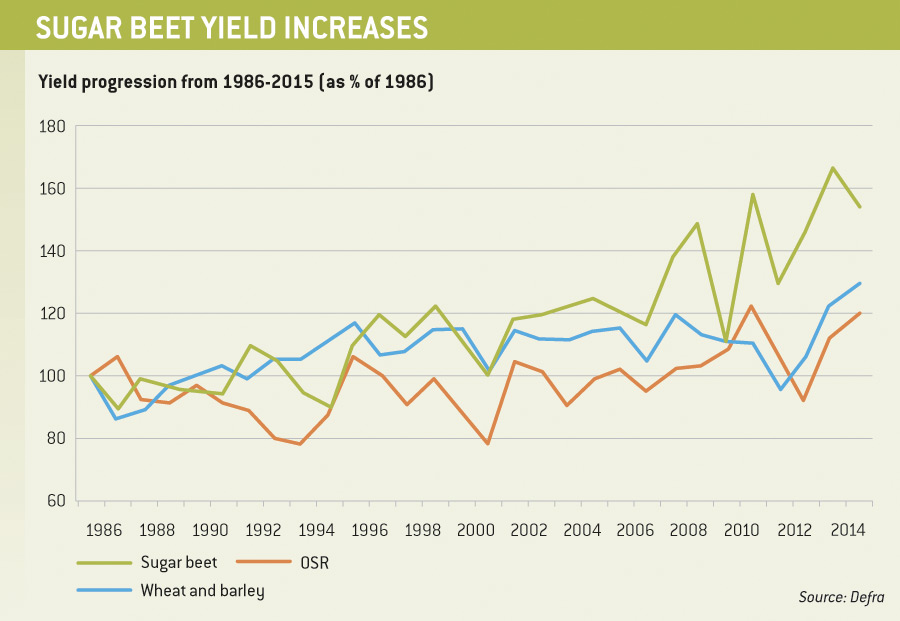

“In this area, it beats oilseed rape hands down, while pulse crops offer it no competition at all.”

Having a choice of contracts and being able to grow on both one-and three-year terms has also been helpful, as has the market price-linked bonus structure, he says.

“These are uncertain times for farmers, so being able to tie into a deal brings some stability and helps with our forward planning.

“If the EU sugar price does get up to €700, it would take us back to where we were three years ago at £31/t.”

He admits to having put a significant proportion of his tonnage into the three-year contract, but has retained some flexibility by having about 25% of his crop area in the one-year contract.

“We were already committed to the crop, and have the advantage of a good harvesting and hauling set-up,” acknowledges Mr Banks.

“With the new contract arrangements, the business has security without being completely tied.”

Sugar beet is grown on both heavy and light land at Thomas Banks and Partners.

As Crops went to press, Mr Banks had just completed lifting and delivering all of the heavy land crop, with yields of around 65t/ha mark.

“If it hadn’t been for the cold start to the season, they would have been more like 75t/ha,” he notes.

“However, the increase in the price being paid, due to the weakness of sterling, will help to balance this out.”